Pitch Deck Teardown: Diamond Standard’s $30M Series A deck

When the financial markets go all wobbly, conservative investors turn to scarce resources that are unlikely to plummet in value, including things like silver, gold, palladium and platinum.

Diamond Standard wants to add diamonds to that list and has created a blockchain-based system to create tokens that gives investors access to diamonds, much like how they trade other precious commodities, including through ETF-like structures on the stock market such as IAU, SLV and PLTM.

The company is bullish on diamonds as an asset class:

“Following 20% returns last year, the Diamond Standard Coin has continued to generate a positive return this year, while the S&P 500 is down 14% and bitcoin is down 50%. Investors need a new uncorrelated asset class, and this capital will enable us to increase capacity and expand our offerings,” said Cormac Kinney, the company’s founder and CEO, in a press release announcing its funding round last year. The Wall Street Journal, Coindesk and Alley Watch also covered the fundraise.

Diamonds are different from gold or silver, however. While gold is gold, it doesn’t matter what shape it is. As long as it is pure and can be melted, in theory, every ounce of gold is worth the same as every other ounce of gold.

That isn’t the case with diamonds. The value of a diamond comes down to four qualities (known as the four Cs). I’ll let Tiffany’s nerd out here, but in short, it’s down to color, clarity, cut and carat (i.e., size). This means it’s hard to make an index fund of diamonds, because they differ in four different dimensions, and one diamond can rarely be swapped like-for-like with another.

For all of those reasons, I got super curious when Diamond Standard submitted its deck for review a while ago. Today, it’s time to take a closer look!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Diamond Standard has an 11-slide deck, and it says it submitted the deck exactly as pitched for its $30 million round. When you look at the full pitch deck, note that the numbering on the slides isn’t consistent (there are two slides numbered “4” in the lower right-hand corner and no slide 6). So in the list below I am using the PDF page numbers.

- Cover and mission slide

- Summary slide

- Solution slide (“Introducing the smart commodity”)

- Problem slide (“Diamonds are severely underallocated”)

- Market Opportunity (marked as slide 4 on the deck)

- Roadmap slide (“How do we make a diamond commodity,” marked as slide 5 on the deck)

- Product slide 1 (“Diamond Standard Exchange”)

- Product slide 2 (“Diamond Standard Recycling”)

- ESG slide (“Diamonds are a powerful ESG investment”)

- Founder slide

- Organization slide

Three things to love

For those of you who’ve been following the full pitch deck teardown series, you may have noticed that there’s quite a lot of information missing from this deck, even just based on the list of slides. I’ll get to that in a moment because we do have some highlights to celebrate first.

Opening with the mission

I often advocate for a strong slide 1+2 combo to set the tone for a pitch. Diamond Standard takes that to the next level by putting its mission on the very first slide. It’s a refreshingly direct way to start:

[Slide 1] Solid opener! Image Credits: Diamond Standard

Diamond Standard’s choice to put its mission front and center is a solid one. It lists its core mission (“To benefit investors by establishing diamonds as a liquid hard asset like gold.”) and then goes into some of the more tactical aspects of what it’s doing: creating digital assets that can be used to create fungible diamond commodities, enabling liquidity and creating diamond-backed futures, options, funds and exchange-traded securities.

There’s a lot going on on this slide and I’m sure designers would have a thing or two to say about how it’s put together. But it accomplishes something really important: It explains with great clarity the what and how of the company’s planned operations. That’s a hell of an accomplishment for a complex business such as this, and putting that information front and center is downright inspired.

Cracking the diamond conundrum

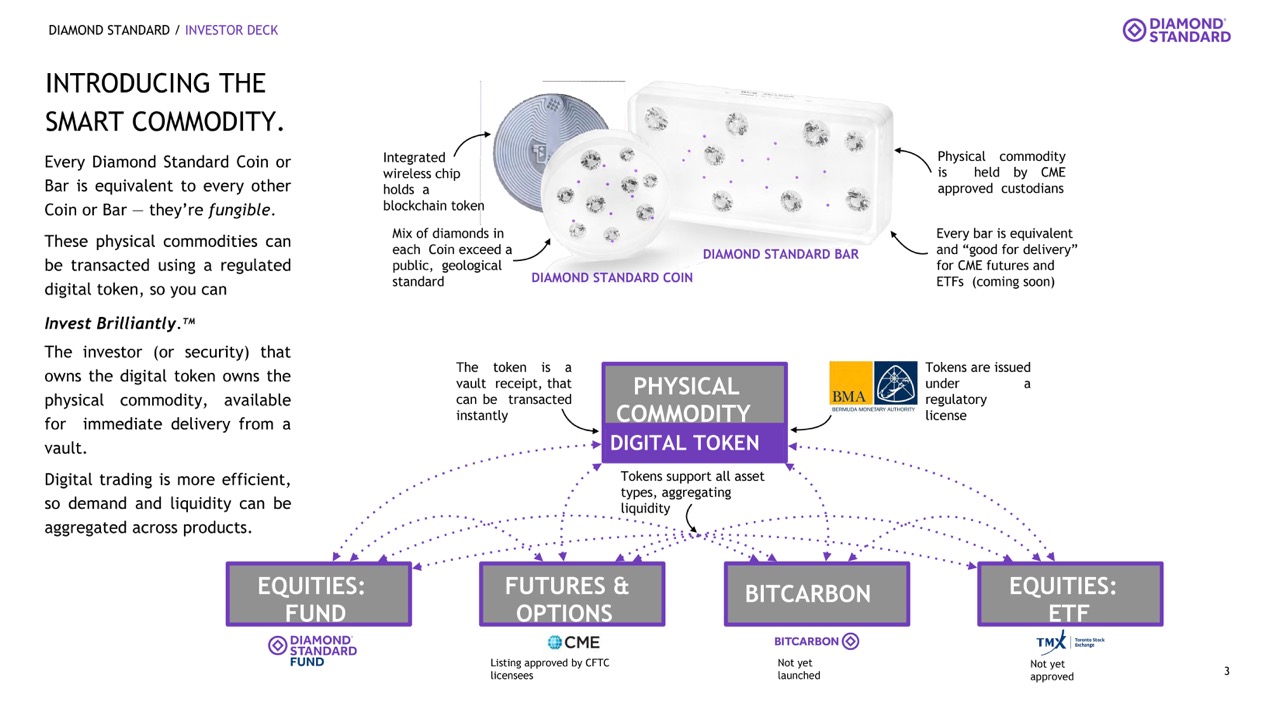

Remember what I said about diamonds being different and, therefore, hard to commoditize? Diamond Standard has a solution: It puts a bunch of diamonds into a single coin or bar and claims that averages out the diamonds’ value, making each unit fungible. In other words: Every unit should be worth as much as every other unit.

[Slide 3] Making diamonds fungible. Image Credits: Diamond Standard

Diamond Standard’s way around the individuality of diamonds is pretty clever. Instead of arguing over the individual value of a diamond, it simply heaps a bunch of diamonds together, puts them into a single unit (called a coin or a bar) and slaps a blockchain token onto the unit. The bars of diamonds are kept in a CME-approved storage facility, and the bars and coins can be sold based on who holds the digital tokens.

If you want your actual bar or coin, you can request it to be shipped to you so you can bury it in a hole in the ground behind your house, keep it in a safe or juggle them while giggling maniacally.

Again, this slide isn’t going to win any prizes for design (What are all of those arrows for? Why so much text?), but it does have a major benefit: It explains how the company solves one of the core problems with turning diamonds into a tradable standard without having to go through an inspection by a balding, belouped diamond expert called “The Head.” I also hereby admit that all my knowledge of the diamond trade is from watching “Snatch” a couple hundred times, so perhaps take that part of my commentary with a couple pinches of diamond dust.

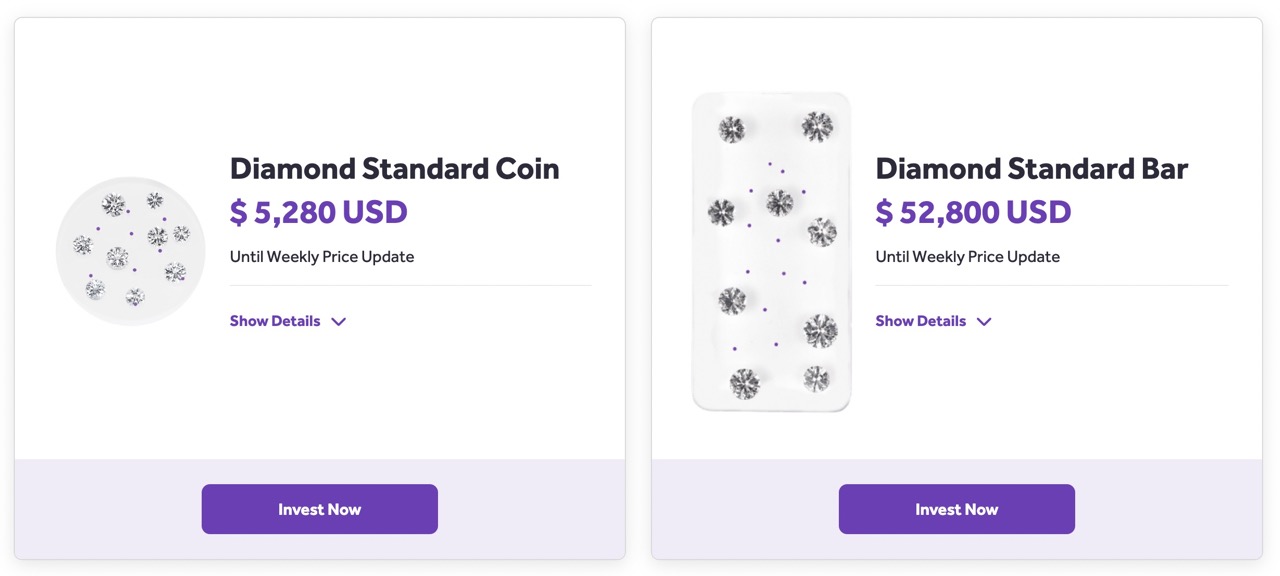

As I am writing this, the diamond-encrusted stones are worth $5,280. The bars are worth an order of magnitude more. Image Credits: Diamond Standard’s website, via screenshot

A hell of an opportunity

For Diamond Standard to make sense, you have to believe three things:

- Investors will want to continue to invest in precious commodities.

- Diamonds could be one of those commodities.

- Diamond Standard’s approach to turning diamonds into such a commodity makes sense.

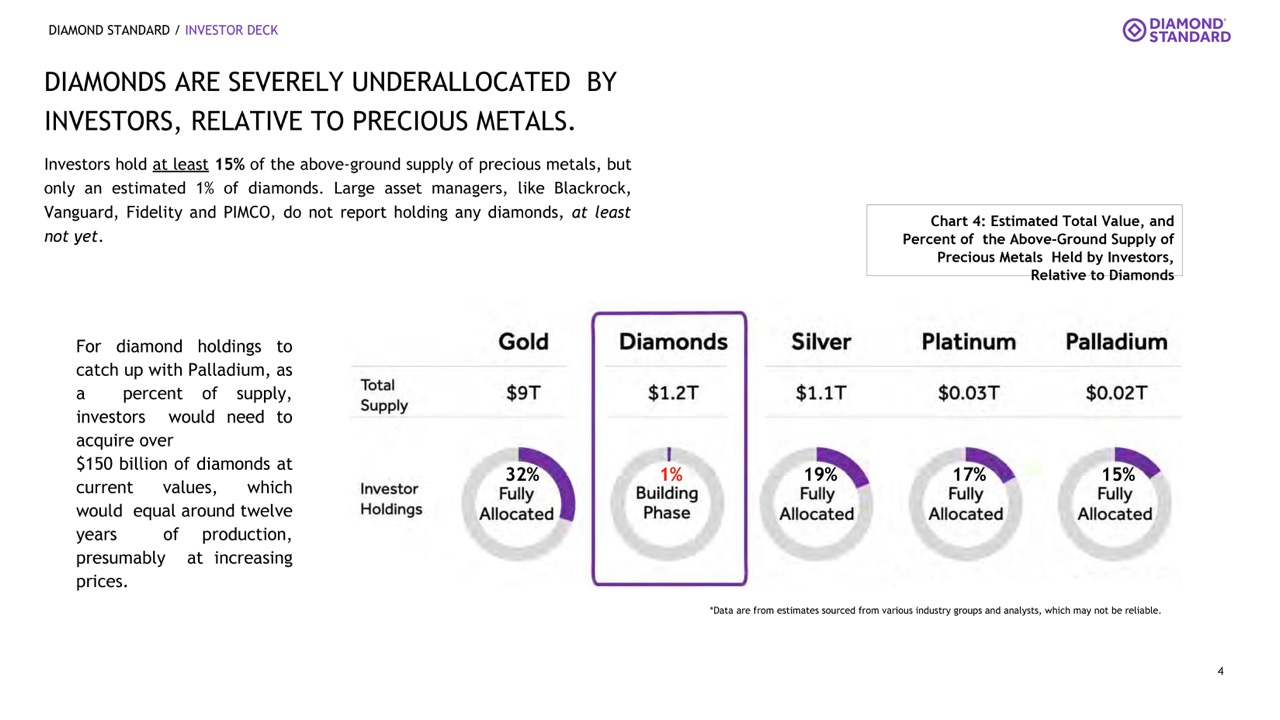

[Slide 4] Opportunities galore. Image Credits: Diamond Standard

If I were to summarize this slide, I’d say “A rising tide raises all boats, and a tide is a-coming.”

If (and that’s the big “if” here) Diamond Standard can convince investors that this is a new commodity worth trading, it’s easy to see that there’s a huge market available for the picking here. For starters, there will be a speculative opportunity as the market picks up, and once it saturates, there will be an ongoing opportunity for buy-and-hold investors — the same category of investors who buy precious metals.

What you can learn from this slide is that if you can visually align yourself with a competitive alternative to a few huge, well-established markets, you’re in a really interesting and compelling position as a potential investment.

Three things that could be improved

It’s mind-boggling to me that Kinney’s five years of experience in the jewelry industry didn’t warrant a mention on the team page of a company that’s doing something related to … diamonds.

I’m not gonna lie, there is a lot that I absolutely detest about this deck. The design is awful. There’s a lot of data missing, and based on this deck alone, I suspect the company would’ve had to suffer through a long and painful due diligence process to raise its funding.

Having said that, the company did raise $30 million from an illustrious group of investors (co-led by Left Lane Capital and Horizon Kinetics) and I suspect that the opportunity was simply too big to let a subpar deck get in the way of an investment round.

In the rest of this teardown, we’ll take a look at three things Diamond Standard could have improved or done differently, along with its full pitch deck!

Pitch Deck Teardown: Diamond Standard’s $30M Series A deck by Haje Jan Kamps originally published on TechCrunch